Join the 67,500+ members who bank with us!

Lock'N'Block®

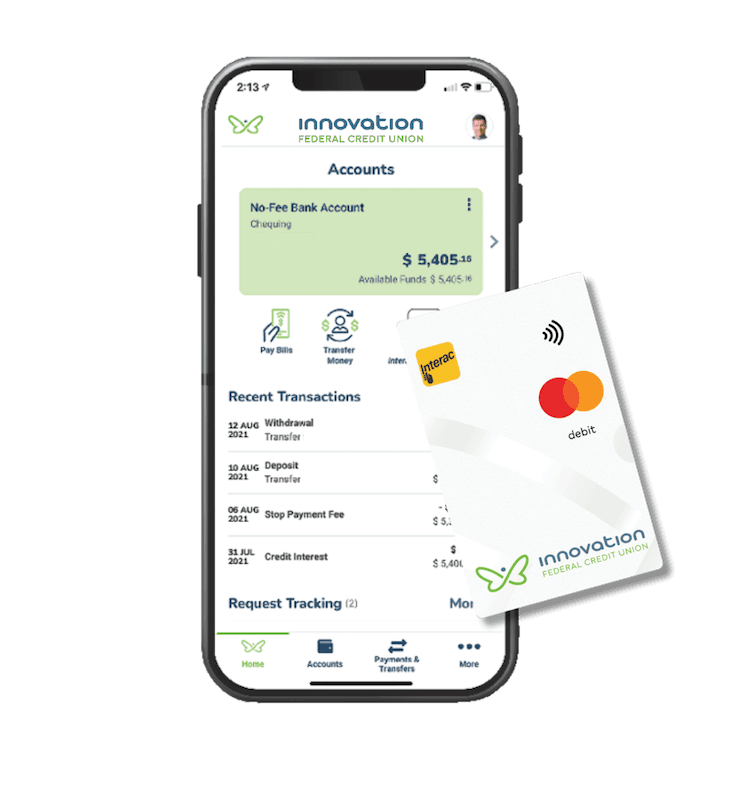

You can prevent debit card/Debit Mastercard® fraud in seconds through your mobile app or online banking:

- lock your debit card,

- block ATM transactions,

- block purchases and refunds, and

- block all international transactions.

To access Lock'N'Block through online banking or our mobile app:

- Log in

- Click More > Manage Card > Lock'N'Block®

If your card has been lost or stolen, the next step is to contact us immediately:

- 1.866.446.7001 during business hours and

- 1.888.277.1043 after business hours

Interac e-Transfer® Autodeposit

Interac e-Transfer is a convenient and safe way to transfer and receive money to and from your friends, family, and businesses. Safety issues can arise however when:

- you use an easy security question,

- you share the answer to the security question in the message box, or

- fraudsters send phishing links that look like an Interac e-Transfer to fool you.

To make Interac e-Transfer even better, we recommend trying Interac e-Transfer Autodeposit. It’s a fantastic feature that addresses the above-mentioned phishing and security question issues. Plus, it saves you time because:

- Your funds will automatically be deposited into your account without the need to login to your app or online banking.

- It eliminates the need to answer security questions.

Signing up for Interac e-Transfer Autodeposit is easy:

- Log into online banking or your mobile app.

- Choose Payments & Transfers > Interac e-Transfer® > Autodeposit Settings

- Register your mobile phone number or email address and link the account.

- Choose Complete Registration in the confirmation email.

Innovation Banking Alerts

Add protection and convenience to your online banking experience with banking alerts. Receive an email or text message when online activity occurs on your accounts including:

- Someone has changed your digital banking password.

- Someone has attempted to access your account.

- Someone has added a new bill payment vendor or Interac e-Transfer® recipient to your profile.

- Your account balance is running low.

To access banking alerts, simply:

- Log in to online banking or our mobile app.

- Choose Profile > Manage Alerts

Low Balance Banking Alerts - Requirement

As part of a banking requirement to help you avoid fees and prevent fraud, you will be automatically registered to receive low balance banking alerts. This means we’ll notify you if:

- the actual balance (excluding any overdraft protection) of your personal deposit account(s) drops below an amount you set (or $100 by default), and

- the available credit on your line of credit and/or overdraft protection drops below the amount you set (or $100 by default).

If we don’t have your Canadian mobile number or email, you won’t receive any alerts.

You won’t receive reminder alerts if your account balance remains below your alert threshold amount. However, you will receive new alerts if you make additional transactions, and your balance is still below your set threshold. You’ll also receive a new alert if you later go above your threshold and then fall back below it again.

You can opt out of receiving alerts at any time:

- Log into digital banking

- Select your profile icon, then select Manage Alerts > Balance & Transaction Alerts

- Not a digital banker? Give us a call at 1.866.446.7001.

How can I stay safe while banking?

Investment Scams

Investment scams are a common method used by fraudsters to prey on those looking to secure their future and save for big purchases. These scams often promise unrealistic returns, taking money away from hard-working Canadians. In 2024, the Canadian Anti-Fraud Centre (CAFC) reported that $310 million was lost to investment fraud. It's important to note that this figure could be even higher, as many incidents go unreported! Remember, do not take investment advice from strangers online, and if the returns seem too good to be true, they probably are.

Law Enforcement Scam

Fraudsters succeed by scaring people. That’s why the law enforcement scam is becoming more and more popular. In this scam, fraudsters impersonate law enforcement officers or other Canadian authorities and threaten you with some form of punishment unless you pay a fee. This fee is how they scam you out of your money. If you ever suspect that you are experiencing a law enforcement scam, hang up and call the direct number of the agency the caller claims to be from.

Marketplace Scam

One of the best ways to save money is to buy secondhand items, which is why platforms like Facebook Marketplace are so popular. However, many scammers use these platforms as well. They pose as sellers, asking you to pay for the product before meeting in person, or as buyers, using illegitimate payment options to get your details and the product for free.

It’s important to remember that there are far more scams out there, with new ones coming out every day. It's crucial to remember that there are many types of scams, with new ones emerging every day. To keep yourself safe online, stay skeptical and don't hesitate to say no. If you suspect you may be experiencing a scam, refuse any suspicious request. You can always verify your concerns with our team at Innovation later!

We’re sorry to hear you’ve been a victim of fraud. It can happen to anyone. Here are some tips to help you get through this:

- Report the scam to any relevant parties. For example, if someone has stolen your identity and used your credit card, contact the organization that issued the card. They can guide you on the next steps to protect yourself online and possibly recover your lost funds.

- Notify the Canadian Anti-Fraud Centre and local law enforcement about the scam. They can help shut down the scam if possible and raise awareness to prevent others from falling victim.

- Change all your passwords and scan your devices for any harmful software that may have been left behind.

- Contact Innovation at 1 (866) 446-7001 for assistance with any concerns or questions you may have.

Although there are many resources available to help you protect yourself from scams, there are steps you can take to prepare yourself as well:

- Create strong passwords: Choose complex passwords with a mix of symbols and numbers, and make sure each account has a unique password.

- Keep software up to date: Regularly update your device and apps to ensure you have the latest security features. Many updates include critical security improvements.

- Use security features: Innovation offers valuable built-in security features like Lock'N'Block® and one-time password authentication, which help protect your personal data and funds.

- Monitor your accounts: Regularly check your account balances and activity to catch any suspicious behavior early. Make it a habit to review your accounts a few times a week.

- Be skeptical: Don't hesitate to say no to suspicious requests and avoid clicking on links that might not be legitimate. You can always contact the organization directly to make sure you aren’t being scammed.