Join the 67,500+ members who bank with us!

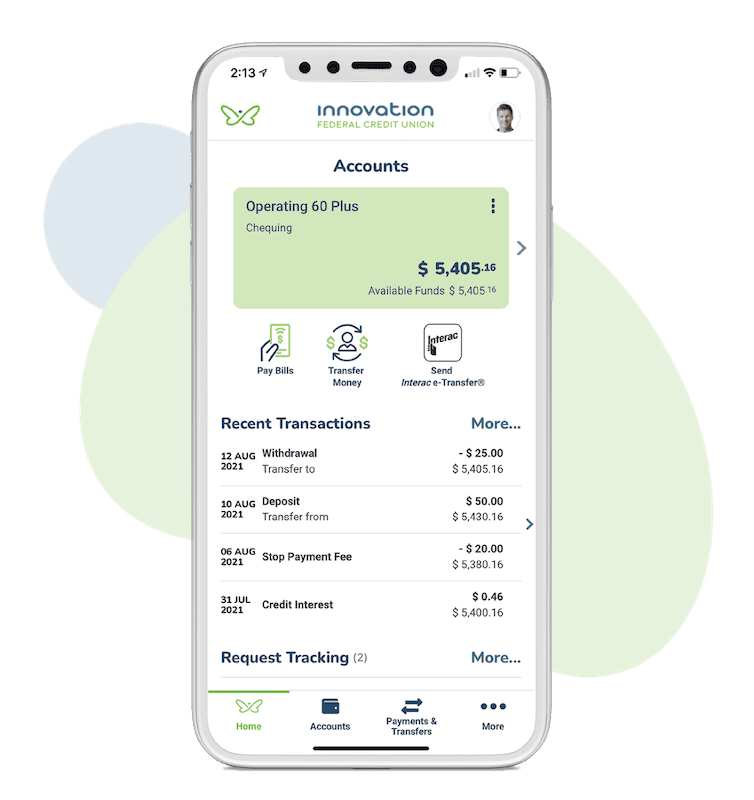

With our digital banking options, you can send and receive money through Interac e-Transfer®, pay bills, deposit a cheque through your phone, check your balance and more.

Other Convenient Digital Features & Services

Budget Tool

Take control of your life and reach your goals faster with our completely FREE budgeting tool on your mobile banking app and online banking! Learn More >

Apple Pay*

Apple Pay is the easier, safer way to pay with your debit card/Debit Mastercard®. Enjoy all the benefits of your Innovation debit card/Debit Mastercard® with Apple Pay on iPhone, Apple Watch, iPad and Mac. Using Apple Pay is simple, and it works with the devices you use every day. Your card information is secure because it isn’t stored on your device or shared when you pay. Paying in stores, apps and online has never been easier, safer or more private.*

How to add a card:

Adding your card to Apple Pay is simple. Here’s how to get started.

- On iPhone, open the Wallet app and tap the “+” sign.

- For Apple Watch, open the Apple Watch app on your iPhone and select “Wallet & Apple Pay,” then tap “Add Credit or Debit Card.”

- On iPad, go to Settings, open “Wallet & Apple Pay,” and select “Add Credit or Debit Card.”

- On MacBook Pro with Touch ID, go to System Preferences, select “Wallet & Apple Pay,” then select “Add Card.”*

Google Pay

Google Pay is the fast, simple way to pay in millions of places — online, in stores, and more. It brings together everything you need at checkout and protects your payment info with multiple layers of security. Plus, you can manage your account wherever you want - on the web or in the app.

How to add a card:

- Download the app from Google Play or check to see if it’s already installed on the phone. Then, follow the easy instructions. Google Pay works on Android devices running Lollipop 5.0 or above.

- Add credit, debit or rewards cards to your Google Wallet — it’s as simple as snapping a picture.

Easy Foreign Exchange

Easily transfer money to and from your No-Fee USD Account through your mobile app or online banking!

- Take instant advantage of current exchange rates.

- Enjoy free transfers.

- Bank from the comfort of home.

Start banking how you want, when you want, 24/7 today! Contact us to get started.

Create Your Legal Will Online through Willful

Make a will online through Willful in under 20 minutes! You’ll receive a 20% discount for being an Innovation member. Learn More >

Joint accounts and POA

It’s important to know the advantages and risks of joint accounts and Power of Attorney (pdf). Planning can help you:

- Manage your money and property today

- Help you and your loved ones manage your affairs in the future

However, you should never feel pressured to open or sign either.

Please note: If you're opening a joint account with a POA, we may require you or your attorney to present the original POA or a notarized copy of the POA. We will require proper identification from both you and the attorney to meet anti-money laundering and other legal requirements.

See our informational brochure - What every older Canadian should know about Powers of Attorney and Joint Bank Accounts.

Trust Accounts

Open a basic trust account for your child, an informal trust account to help fundraise for a group or person, or a legal trust account as part of a Will.

Senior Services

Learn more about our free products and services, support in your financial life, and helpful resources for you and your family.

If you have any questions about our other accounts and services, or would like to open one, contact us today!

Some conditions apply. Ag/Business Loans are ineligible. Qualifying loans are eligible for one skipped payment per Skip-Your-Payment fiscal year. Interest will continue to accrue and be payable on the unpaid principal amount of the skipped payment but not on the unpaid interest. The original expiry date of the loan (if applicable) may be extended to accommodate this skipped payment.

Apple Pay works with iPhone 6 and later in stores, apps and websites in Safari; with Apple Watch in stores and apps (requires iPhone 6 or later); with iPad Pro, iPad (5th generation), iPad Air 2, and iPad mini 3 and later in apps and websites in Safari; and with Mac (2012 or later) in Safari with an Apple Pay–enabled iPhone or Apple Watch. For a list of compatible Apple Pay devices, see support.apple.com/km207105.